All Categories

Featured

Table of Contents

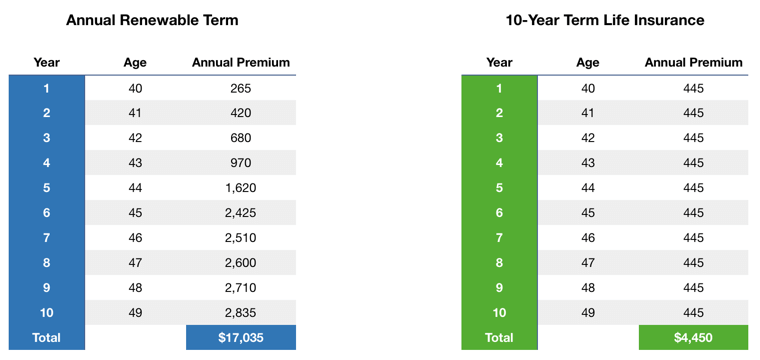

A degree term life insurance coverage plan can provide you comfort that the people who depend upon you will have a death advantage throughout the years that you are preparing to support them. It's a method to assist care for them in the future, today. A level term life insurance policy (sometimes called degree costs term life insurance coverage) plan provides insurance coverage for a set variety of years (e.g., 10 or twenty years) while maintaining the costs payments the very same throughout of the policy.

With level term insurance coverage, the expense of the insurance coverage will certainly remain the same (or possibly decrease if returns are paid) over the term of your plan, normally 10 or 20 years. Unlike long-term life insurance policy, which never ever expires as long as you pay costs, a level term life insurance policy plan will certainly end at some point in the future, typically at the end of the duration of your degree term.

What is Level Premium Term Life Insurance Policies? Quick Overview

Due to this, many individuals make use of long-term insurance as a secure economic preparation tool that can serve lots of needs. You might have the ability to transform some, or all, of your term insurance policy throughout a set duration, commonly the very first ten years of your policy, without needing to re-qualify for protection also if your health and wellness has actually changed.

As it does, you may want to include to your insurance policy protection in the future - 20-year level term life insurance. As this occurs, you may want to eventually reduce your death advantage or take into consideration transforming your term insurance to a permanent plan.

Life insurance isn’t just a policy; it’s a powerful way to secure your family’s financial stability. From protecting your loved ones from unexpected costs to planning for the future, the right life insurance policy ensures peace of mind. Term life insurance is a popular choice for those seeking temporary, cost-effective coverage, while whole life insurance provides lifelong protection and cash value growth. Universal life insurance is another flexible option, ideal for families and individuals looking to balance affordability with long-term financial goals.

For specific needs, final expense insurance ensures funeral costs are covered, and mortgage protection life insurance provides reassurance that your family can stay in their home. Accidental death insurance adds another layer of security for unique situations (final expense coverage for seniors through brokers). Many of these policies also include living benefits, allowing policyholders to access funds during critical times, such as illness or emergencies

Life insurance isn’t just about protecting your loved ones; it’s also a strategic tool for building a solid financial foundation. Speak with a licensed insurance agent today to explore policies designed for your specific needs, whether you’re planning for retirement, saving for college, or securing your family’s future. Request a free quote now to start building a secure tomorrow.

So long as you pay your premiums, you can rest simple knowing that your liked ones will certainly obtain a fatality benefit if you pass away throughout the term. Numerous term policies allow you the capacity to transform to permanent insurance policy without having to take one more wellness examination. This can allow you to take benefit of the fringe benefits of an irreversible plan.

Degree term life insurance policy is just one of the easiest paths right into life insurance, we'll talk about the benefits and drawbacks to ensure that you can select a strategy to fit your requirements. Degree term life insurance policy is the most common and standard type of term life. When you're trying to find short-lived life insurance plans, level term life insurance policy is one path that you can go.

You'll fill up out an application that has general personal information such as your name, age, and so on as well as a more detailed set of questions concerning your medical background.

The brief solution is no., for instance, let you have the convenience of fatality advantages and can accumulate money worth over time, indicating you'll have a lot more control over your benefits while you're to life.

The Ultimate Guide: What is Term Life Insurance For Couples?

Cyclists are optional arrangements added to your policy that can provide you additional benefits and defenses. Anything can happen over the training course of your life insurance policy term, and you desire to be prepared for anything.

This motorcyclist supplies term life insurance policy on your kids via the ages of 18-25. There are instances where these advantages are built right into your policy, yet they can likewise be offered as a separate enhancement that calls for added settlement. This cyclist gives an added fatality advantage to your recipient ought to you die as the outcome of an accident.

Latest Posts

Funeral Insurance Definition

Best Funeral Policy

Best Life Insurance For Funeral Expenses