All Categories

Featured

Table of Contents

Life insurance isn’t just a policy; it’s a powerful way to secure your family’s financial stability. From protecting your loved ones from unexpected costs to planning for the future, the right life insurance policy ensures peace of mind. Term life insurance is a popular choice for those seeking temporary, cost-effective coverage, while whole life insurance provides lifelong protection and cash value growth. Universal life insurance is another flexible option, ideal for families and individuals looking to balance affordability with long-term financial goals.

For specific needs, final expense insurance ensures funeral costs are covered, and mortgage protection life insurance provides reassurance that your family can stay in their home. Accidental death insurance adds another layer of security for unique situations (universal life insurance tax advantages explained by brokers). Many of these policies also include living benefits, allowing policyholders to access funds during critical times, such as illness or emergencies

Life insurance isn’t just about protecting your loved ones; it’s also a strategic tool for building a solid financial foundation. Speak with a licensed insurance agent today to explore policies designed for your specific needs, whether you’re planning for retirement, saving for college, or securing your family’s future. Request a free quote now to start building a secure tomorrow.

That usually makes them an extra cost effective option for life insurance policy coverage. Many individuals obtain life insurance coverage to aid monetarily secure their enjoyed ones in situation of their unforeseen death.

Or you may have the choice to transform your existing term coverage right into an irreversible plan that lasts the remainder of your life. Different life insurance policies have potential advantages and disadvantages, so it's important to understand each before you choose to buy a plan.

As long as you pay the premium, your recipients will obtain the death benefit if you pass away while covered. That claimed, it is very important to keep in mind that a lot of policies are contestable for 2 years which implies insurance coverage might be retracted on death, needs to a misrepresentation be found in the application. Plans that are not contestable often have a graded death benefit.

Premiums are normally less than whole life policies. With a degree term plan, you can choose your protection amount and the plan size. You're not locked into an agreement for the remainder of your life. Throughout your plan, you never have to fret about the premium or death advantage quantities altering.

And you can not pay out your plan throughout its term, so you won't obtain any type of financial benefit from your previous coverage. As with other kinds of life insurance policy, the price of a degree term policy relies on your age, protection needs, employment, way of living and wellness. Usually, you'll discover more budget-friendly insurance coverage if you're more youthful, healthier and much less risky to guarantee.

Best Level Premium Term Life Insurance Policies

Considering that degree term costs remain the very same throughout of coverage, you'll know exactly how much you'll pay each time. That can be a large help when budgeting your expenditures. Level term insurance coverage additionally has some flexibility, enabling you to tailor your policy with additional functions. These usually can be found in the kind of motorcyclists.

You might have to meet specific conditions and certifications for your insurance provider to establish this cyclist. There likewise might be an age or time limitation on the insurance coverage.

The death benefit is typically smaller, and protection typically lasts till your kid transforms 18 or 25. This biker may be a more economical means to aid guarantee your kids are covered as cyclists can usually cover several dependents at as soon as. When your child ages out of this protection, it may be possible to transform the cyclist right into a brand-new plan.

When comparing term versus irreversible life insurance policy. term to 100 life insurance, it's vital to keep in mind there are a couple of different kinds. The most common kind of long-term life insurance policy is entire life insurance policy, however it has some essential differences compared to level term protection. Below's a basic review of what to consider when contrasting term vs.

Whole life insurance policy lasts forever, while term protection lasts for a specific duration. The costs for term life insurance policy are typically reduced than entire life protection. Nonetheless, with both, the costs remain the exact same for the period of the policy. Whole life insurance coverage has a money worth part, where a section of the costs may expand tax-deferred for future demands.

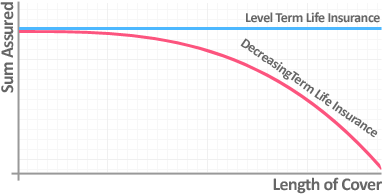

Among the main attributes of degree term coverage is that your premiums and your fatality benefit do not alter. With lowering term life insurance policy, your premiums remain the exact same; nonetheless, the fatality advantage quantity obtains smaller sized in time. You might have coverage that begins with a death advantage of $10,000, which might cover a mortgage, and then each year, the death benefit will certainly reduce by a collection quantity or percentage.

Due to this, it's frequently an extra inexpensive type of degree term protection., but it may not be sufficient life insurance policy for your demands.

After selecting a plan, finish the application. For the underwriting procedure, you might have to offer general personal, wellness, way of living and work details. Your insurance provider will determine if you are insurable and the threat you might offer to them, which is reflected in your premium expenses. If you're accepted, authorize the documents and pay your very first premium.

Coverage-Focused Annual Renewable Term Life Insurance

Finally, think about scheduling time every year to examine your policy. You might want to update your recipient info if you've had any type of significant life changes, such as a marital relationship, birth or divorce. Life insurance coverage can often really feel complicated. Yet you do not need to go it alone. As you discover your alternatives, take into consideration discussing your requirements, wants and interests in a financial expert.

No, degree term life insurance policy does not have cash money value. Some life insurance policy policies have a financial investment attribute that allows you to develop cash worth gradually. A part of your premium settlements is alloted and can earn rate of interest in time, which expands tax-deferred throughout the life of your coverage.

Nonetheless, these plans are commonly considerably much more costly than term insurance coverage. If you get to the end of your plan and are still alive, the coverage ends. You have some choices if you still want some life insurance protection. You can: If you're 65 and your protection has run out, for instance, you may wish to purchase a brand-new 10-year level term life insurance policy.

Reliable What Is Decreasing Term Life Insurance

You may have the ability to convert your term insurance coverage into a whole life policy that will certainly last for the rest of your life. Numerous types of level term plans are exchangeable. That indicates, at the end of your coverage, you can convert some or every one of your plan to entire life coverage.

Degree term life insurance is a policy that lasts a set term normally in between 10 and three decades and comes with a level survivor benefit and degree costs that remain the very same for the entire time the plan is in impact. This suggests you'll know specifically just how much your settlements are and when you'll need to make them, enabling you to budget plan accordingly.

Level term can be a terrific alternative if you're wanting to get life insurance policy protection for the very first time. According to LIMRA's 2023 Insurance policy Measure Research, 30% of all grownups in the U.S. requirement life insurance coverage and don't have any kind of type of policy yet. Degree term life is foreseeable and affordable, that makes it one of the most preferred kinds of life insurance policy.

Latest Posts

Funeral Insurance Definition

Best Funeral Policy

Best Life Insurance For Funeral Expenses