All Categories

Featured

Table of Contents

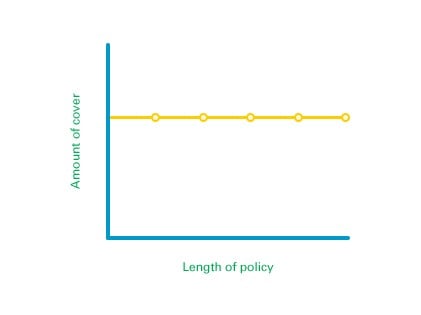

A level term life insurance policy plan can provide you assurance that the individuals that depend upon you will have a death benefit during the years that you are intending to support them. It's a method to assist take care of them in the future, today. A degree term life insurance coverage (sometimes called level costs term life insurance policy) policy supplies protection for an established variety of years (e.g., 10 or twenty years) while keeping the premium repayments the exact same throughout of the policy.

Life insurance isn’t just a policy; it’s a powerful way to secure your family’s financial stability. From protecting your loved ones from unexpected costs to planning for the future, the right life insurance policy ensures peace of mind. Term life insurance is a popular choice for those seeking temporary, cost-effective coverage, while whole life insurance provides lifelong protection and cash value growth. Universal life insurance is another flexible option, ideal for families and individuals looking to balance affordability with long-term financial goals.

For specific needs, final expense insurance ensures funeral costs are covered, and mortgage protection life insurance provides reassurance that your family can stay in their home. Accidental death insurance adds another layer of security for unique situations (universal life insurance for long-term growth with brokers). Many of these policies also include living benefits, allowing policyholders to access funds during critical times, such as illness or emergencies

Life insurance isn’t just about protecting your loved ones; it’s also a strategic tool for building a solid financial foundation. Speak with a licensed insurance agent today to explore policies designed for your specific needs, whether you’re planning for retirement, saving for college, or securing your family’s future. Request a free quote now to start building a secure tomorrow.

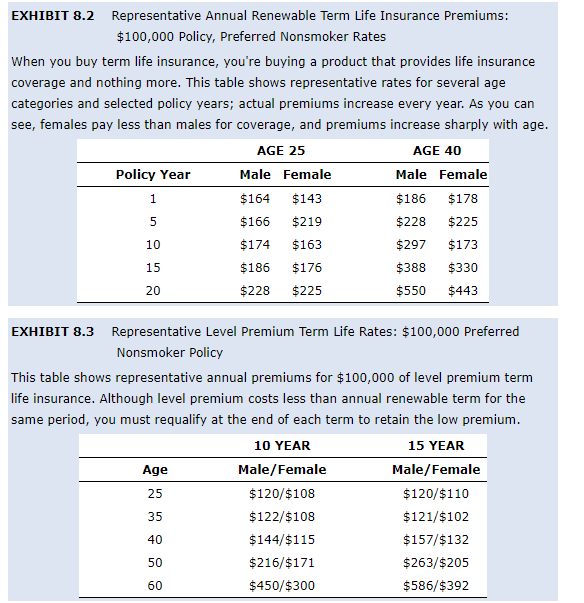

With degree term insurance, the expense of the insurance will certainly stay the same (or possibly reduce if rewards are paid) over the term of your policy, normally 10 or 20 years. Unlike irreversible life insurance policy, which never ends as lengthy as you pay costs, a degree term life insurance policy policy will finish eventually in the future, normally at the end of the period of your degree term.

Is Voluntary Term Life Insurance a Good Option for You?

Due to this, lots of people use permanent insurance as a secure economic planning device that can serve several requirements. You may have the ability to transform some, or all, of your term insurance policy throughout a set duration, commonly the initial ten years of your plan, without needing to re-qualify for protection also if your health and wellness has actually changed.

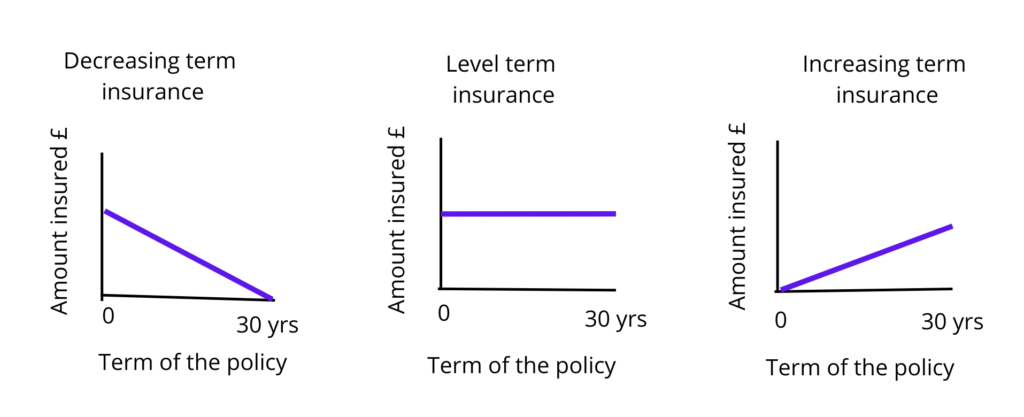

As it does, you might want to add to your insurance protection in the future - Level term vs decreasing term life insurance. As this happens, you may desire to at some point minimize your fatality benefit or think about converting your term insurance policy to a long-term policy.

As long as you pay your premiums, you can rest simple knowing that your liked ones will certainly get a fatality benefit if you die during the term. Lots of term policies enable you the capacity to convert to long-term insurance coverage without needing to take an additional health and wellness test. This can enable you to make the most of the fringe benefits of an irreversible policy.

Degree term life insurance policy is among the most convenient paths right into life insurance policy, we'll go over the advantages and drawbacks to ensure that you can choose a plan to fit your requirements. Level term life insurance coverage is one of the most usual and fundamental type of term life. When you're searching for momentary life insurance plans, level term life insurance is one path that you can go.

The application procedure for degree term life insurance coverage is commonly extremely uncomplicated. You'll submit an application which contains basic individual information such as your name, age, etc as well as a much more detailed questionnaire concerning your medical history. Depending on the policy you're interested in, you might have to get involved in a clinical examination procedure.

The short answer is no. A degree term life insurance coverage plan doesn't develop money value. If you're aiming to have a policy that you have the ability to take out or borrow from, you may check out irreversible life insurance policy. Whole life insurance coverage plans, for example, let you have the comfort of fatality benefits and can accrue money worth over time, suggesting you'll have extra control over your benefits while you live.

What is the Meaning of What Is A Level Term Life Insurance Policy?

Cyclists are optional stipulations added to your plan that can provide you added advantages and protections. Anything can happen over the program of your life insurance term, and you want to be ready for anything.

This motorcyclist gives term life insurance policy on your youngsters through the ages of 18-25. There are circumstances where these benefits are built into your policy, but they can additionally be available as a different addition that needs extra payment. This cyclist offers an additional survivor benefit to your beneficiary needs to you pass away as the result of an accident.

Latest Posts

Funeral Insurance Definition

Best Funeral Policy

Best Life Insurance For Funeral Expenses