All Categories

Featured

Table of Contents

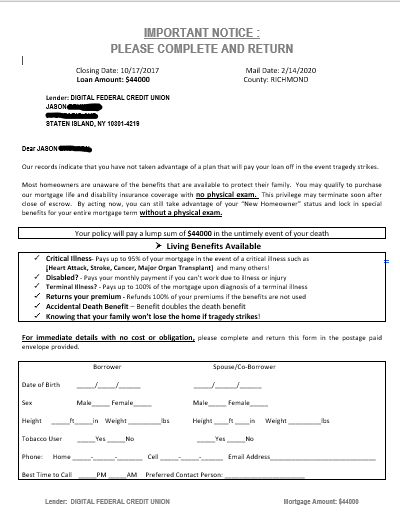

Home mortgage life insurance policy gives near-universal protection with minimal underwriting. There is commonly no medical exam or blood sample required and can be a useful insurance plan option for any homeowner with significant pre-existing medical conditions which, would avoid them from purchasing standard life insurance policy. Various other benefits include: With a home loan life insurance policy in position, heirs won't need to stress or wonder what might occur to the family home.

With the home mortgage paid off, the family will constantly have a place to live, provided they can manage the home taxes and insurance annually. why do you pay mortgage insurance.

There are a few various sorts of home mortgage protection insurance policy, these consist of:: as you pay more off your mortgage, the quantity that the plan covers decreases in accordance with the superior balance of your mortgage. It is the most common and the most inexpensive type of home mortgage protection - home mortgage protection group.: the amount guaranteed and the costs you pay stays degree

This will pay off the home loan and any type of continuing to be balance will certainly go to your estate.: if you desire to, you can include serious disease cover to your mortgage defense plan. This implies your home loan will certainly be gotten rid of not just if you die, however additionally if you are diagnosed with a significant disease that is covered by your policy.

Home Loan Protection Insurance Plan

Furthermore, if there is a balance remaining after the home loan is removed, this will most likely to your estate. If you transform your home mortgage, there are a number of points to think about, relying on whether you are topping up or expanding your mortgage, changing, or paying the home loan off early. If you are topping up your home loan, you need to make sure that your plan satisfies the new value of your home loan.

Compare the prices and advantages of both options (mortgage protection insurance nationwide). It may be more affordable to maintain your initial home mortgage security plan and after that purchase a second plan for the top-up quantity. Whether you are topping up your home mortgage or extending the term and need to obtain a new policy, you may find that your costs is greater than the last time you took out cover

How Much Is Mortgage Protection Insurance Calculator

When changing your home loan, you can appoint your home loan security to the brand-new lending institution. The premium and degree of cover will be the same as before if the amount you borrow, and the regard to your home mortgage does not change. If you have a policy through your lender's team scheme, your loan provider will certainly terminate the plan when you change your mortgage.

In The golden state, home loan protection insurance covers the entire superior balance of your loan. The death benefit is a quantity equivalent to the equilibrium of your home mortgage at the time of your death.

Home Life Protection Reviews

It's vital to understand that the survivor benefit is given straight to your creditor, not your loved ones. This assures that the remaining debt is paid in complete which your loved ones are saved the financial strain. Mortgage defense insurance policy can additionally offer short-term coverage if you come to be handicapped for an extended duration (generally 6 months to a year).

There are lots of benefits to getting a mortgage security insurance coverage policy in California. Some of the top advantages include: Guaranteed approval: Also if you remain in bad wellness or work in a dangerous career, there is assured approval with no medical exams or lab examinations. The very same isn't true permanently insurance.

Special needs protection: As stated above, some MPI policies make a few home loan settlements if you become impaired and can not bring in the exact same revenue you were accustomed to. It is very important to note that MPI, PMI, and MIP are all different kinds of insurance. Home mortgage protection insurance policy (MPI) is designed to settle a home loan in situation of your death.

Mortgage Insurance Means

You can also apply online in mins and have your plan in place within the very same day. To learn more about getting MPI coverage for your home lending, call Pronto Insurance policy today! Our experienced representatives are here to address any kind of inquiries you might have and give additional support.

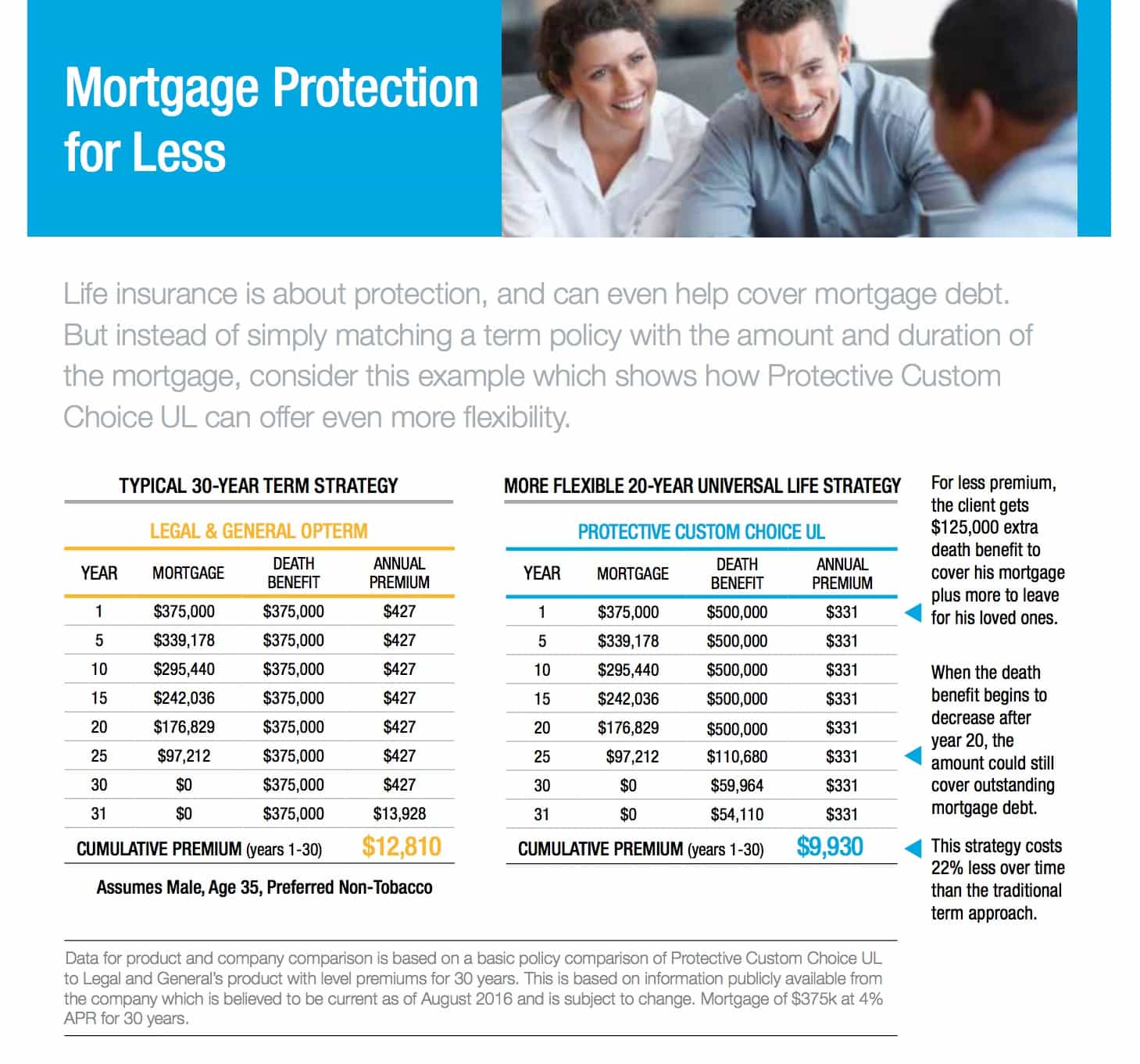

It is recommended to compare quotes from various insurance companies to locate the very best price and protection for your requirements. MPI supplies numerous benefits, such as assurance and streamlined certification processes. However, it has some restrictions. The survivor benefit is directly paid to the loan provider, which restricts adaptability. In addition, the advantage amount reduces in time, and MPI can be more costly than typical term life insurance policy plans.

Low Cost Mortgage Insurance

Get in standard info about on your own and your home mortgage, and we'll compare rates from different insurance firms. We'll additionally show you how much insurance coverage you require to safeguard your mortgage.

The major benefit here is clarity and confidence in your choice, understanding you have a plan that fits your demands. Once you accept the strategy, we'll deal with all the documentation and configuration, ensuring a smooth application procedure. The positive outcome is the satisfaction that includes knowing your family is safeguarded and your home is secure, whatever happens.

Specialist Recommendations: Support from skilled specialists in insurance policy and annuities. Hassle-Free Setup: We deal with all the documentation and implementation. Economical Solutions: Locating the most effective insurance coverage at the least expensive feasible cost.: MPI especially covers your mortgage, offering an additional layer of protection.: We work to find the most cost-effective solutions tailored to your spending plan.

They can offer info on the insurance coverage and benefits that you have. Typically, a healthy person can expect to pay around $50 to $100 each month for mortgage life insurance policy. It's advised to acquire a customized home loan life insurance policy quote to get an accurate price quote based on private scenarios.

Latest Posts

Funeral Insurance Definition

Best Funeral Policy

Best Life Insurance For Funeral Expenses