All Categories

Featured

Table of Contents

Life insurance isn’t just a policy; it’s a powerful way to secure your family’s financial stability. From protecting your loved ones from unexpected costs to planning for the future, the right life insurance policy ensures peace of mind. Term life insurance is a popular choice for those seeking temporary, cost-effective coverage, while whole life insurance provides lifelong protection and cash value growth. Universal life insurance is another flexible option, ideal for families and individuals looking to balance affordability with long-term financial goals.

For specific needs, final expense insurance ensures funeral costs are covered, and mortgage protection life insurance provides reassurance that your family can stay in their home. Accidental death insurance adds another layer of security for unique situations. Many of these policies also include living benefits, allowing policyholders to access funds during critical times, such as illness or emergencies.

Life insurance isn’t just about protecting your loved ones; it’s also a strategic tool for building a solid financial foundation. life insurance with cash value growth from brokers. Speak with a licensed insurance agent today to explore policies designed for your specific needs, whether you’re planning for retirement, saving for college, or securing your family’s future. Request a free quote now to start building a secure tomorrow

It enables you to budget and strategy for the future. You can easily factor your life insurance policy into your budget plan since the costs never ever alter. You can intend for the future simply as quickly since you know precisely just how much money your liked ones will certainly receive in the event of your lack.

This holds true for individuals who quit cigarette smoking or who have a wellness problem that deals with. In these situations, you'll normally have to go via a new application process to get a much better rate. If you still need insurance coverage by the time your level term life policy nears the expiration date, you have a few choices.

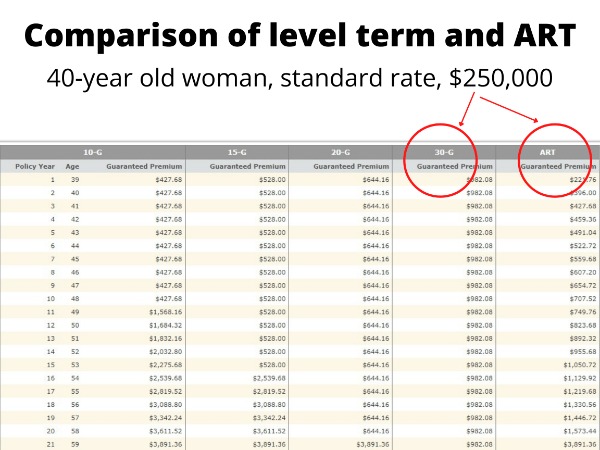

A lot of level term life insurance policies include the option to restore protection on a yearly basis after the initial term ends. does term life insurance cover accidental death. The price of your plan will certainly be based upon your existing age and it'll enhance each year. This can be a good alternative if you only need to expand your protection for a couple of years otherwise, it can obtain expensive pretty promptly

Level term life insurance policy is just one of the most affordable protection choices on the marketplace because it uses standard defense in the form of survivor benefit and only lasts for a collection time period. At the end of the term, it runs out. Whole life insurance, on the other hand, is considerably extra expensive than degree term life due to the fact that it does not expire and includes a cash worth feature.

Trusted Decreasing Term Life Insurance Is Often Used To

Rates might differ by insurance provider, term, protection amount, health course, and state. Not all plans are readily available in all states. Rate picture valid as of 10/01/2024. Degree term is a wonderful life insurance policy option for many people, yet relying on your protection needs and individual circumstance, it could not be the ideal fit for you.

Yearly sustainable term life insurance policy has a regard to only one year and can be renewed every year. Yearly eco-friendly term life premiums are at first reduced than level term life costs, however costs rise each time you renew. This can be a good alternative if you, for instance, have just stop smoking cigarettes and need to wait 2 or three years to look for a level term policy and be eligible for a reduced rate.

Value Guaranteed Issue Term Life Insurance

With a lowering term life plan, your survivor benefit payment will certainly lower over time, yet your settlements will certainly remain the same. Decreasing term life policies like home loan protection insurance policy usually pay out to your loan provider, so if you're trying to find a policy that will certainly pay out to your loved ones, this is not a great suitable for you.

Enhancing term life insurance policies can aid you hedge versus rising cost of living or plan financially for future kids. On the various other hand, you'll pay even more ahead of time for less coverage with an increasing term life plan than with a level term life plan. If you're not sure which sort of policy is best for you, dealing with an independent broker can help.

Once you've chosen that level term is ideal for you, the following step is to acquire your plan. Below's exactly how to do it. Calculate exactly how much life insurance coverage you require Your coverage amount should offer your family's lasting financial needs, including the loss of your earnings in case of your fatality, along with debts and daily expenditures.

A degree costs term life insurance policy strategy allows you adhere to your budget while you assist shield your family. Unlike some tipped rate plans that boosts every year with your age, this sort of term strategy provides prices that stay the very same for the period you choose, also as you age or your wellness modifications.

Find out more concerning the Life insurance policy alternatives readily available to you as an AICPA member. ___ Aon Insurance Providers is the trademark name for the brokerage firm and program management procedures of Fondness Insurance policy Providers, Inc. (TX 13695) (AR 100106022); in CA & MN, AIS Affinity Insurance Coverage Agency, Inc. (CA 0795465); in Okay, AIS Affinity Insurance Policy Solutions Inc.; in CA, Aon Affinity Insurance Coverage Solutions, Inc.

Innovative Level Term Life Insurance

The Plan Representative of the AICPA Insurance Policy Depend On, Aon Insurance Policy Providers, is not associated with Prudential. Group Insurance policy protection is released by The Prudential Insurer of America, a Prudential Financial business, Newark, NJ. 1043476-00002-00.

Latest Posts

Funeral Insurance Definition

Best Funeral Policy

Best Life Insurance For Funeral Expenses