All Categories

Featured

Table of Contents

That typically makes them an extra inexpensive alternative for life insurance protection. Many people get life insurance protection to help financially secure their enjoyed ones in situation of their unexpected death.

Or you may have the option to transform your existing term insurance coverage right into a permanent plan that lasts the remainder of your life. Different life insurance coverage plans have prospective advantages and disadvantages, so it's vital to comprehend each before you choose to acquire a policy.

As long as you pay the premium, your beneficiaries will obtain the survivor benefit if you pass away while covered. That claimed, it is necessary to note that a lot of plans are contestable for two years which indicates coverage can be rescinded on fatality, needs to a misrepresentation be found in the application. Policies that are not contestable often have actually a graded death advantage.

What is What Is Direct Term Life Insurance? Explained in Detail

Premiums are normally less than entire life policies. With a level term policy, you can pick your coverage quantity and the plan length. You're not secured into a contract for the remainder of your life. Throughout your policy, you never need to stress concerning the premium or death benefit amounts changing.

Navigating life insurance options can be overwhelming, especially with so many policies available. This is where working with an experienced insurance broker or agent makes all the difference. Unlike insurance agents tied to a single provider, brokers offer access to multiple life insurance options, helping you find the most suitable policy for your needs - final expense insurance for funeral costs with brokers. Whether it’s term life insurance for temporary coverage, whole life insurance for lifelong protection, or universal life for long-term growth, an insurance broker evaluates your unique goals and compares providers to secure the best coverage at competitive rates

For families, policies like final expense insurance, mortgage protection, and accidental death coverage offer tailored solutions to protect loved ones. Business owners can also benefit from key person insurance, ensuring continuity in the event of an unforeseen loss. With life insurance policies offering living benefits or instant coverage, brokers simplify the decision-making process and ensure your financial priorities are met.

By choosing the right insurance broker, you gain expert guidance, access to personalized recommendations, and the confidence of knowing your family or business is secure. Contact an insurance broker today to explore tailored life insurance options and secure peace of mind for the future.

And you can not squander your plan throughout its term, so you won't get any type of monetary benefit from your previous coverage. Similar to other sorts of life insurance policy, the expense of a level term plan depends on your age, insurance coverage needs, work, way of living and wellness. Normally, you'll locate more budget friendly insurance coverage if you're younger, healthier and less high-risk to insure.

Given that degree term premiums remain the very same for the period of insurance coverage, you'll recognize specifically just how much you'll pay each time. Level term protection also has some adaptability, enabling you to customize your policy with additional functions.

What is Level Premium Term Life Insurance? Your Guide to the Basics?

You may need to meet details problems and certifications for your insurer to enact this cyclist. In enhancement, there might be a waiting duration of as much as 6 months before working. There also might be an age or time limit on the coverage. You can include a child rider to your life insurance coverage policy so it likewise covers your children.

The survivor benefit is normally smaller sized, and insurance coverage usually lasts till your youngster transforms 18 or 25. This motorcyclist might be a much more cost-effective means to aid ensure your children are covered as cyclists can typically cover numerous dependents at as soon as. Once your kid ages out of this protection, it may be possible to transform the motorcyclist right into a new plan.

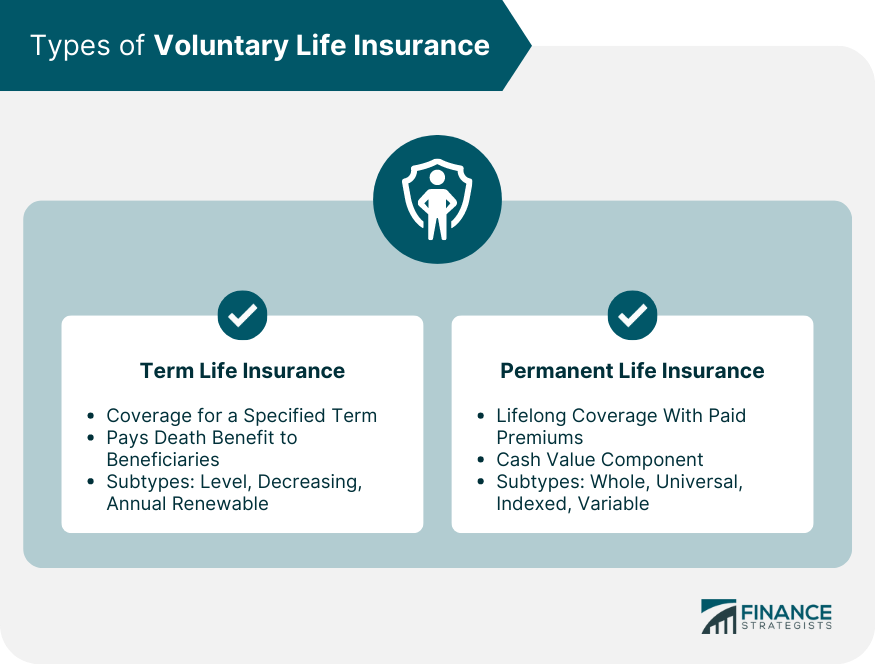

The most common type of irreversible life insurance coverage is whole life insurance coverage, but it has some crucial distinctions contrasted to level term insurance coverage. Right here's a fundamental review of what to think about when comparing term vs.

The Benefits of Choosing What Is Direct Term Life Insurance

Whole life insurance lasts insurance policy life, while term coverage lasts insurance coverage a specific periodParticular The costs for term life insurance policy are generally lower than entire life coverage.

Among the highlights of degree term insurance coverage is that your premiums and your death benefit don't change. With decreasing term life insurance policy, your costs stay the very same; nevertheless, the survivor benefit amount gets smaller gradually. For instance, you might have insurance coverage that begins with a survivor benefit of $10,000, which might cover a home loan, and after that each year, the death advantage will decrease by a collection quantity or percent.

Due to this, it's frequently a much more inexpensive kind of degree term protection., yet it might not be sufficient life insurance for your demands.

The Ultimate Guide: What is Term Life Insurance With Accelerated Death Benefit?

After choosing on a plan, complete the application. If you're accepted, sign the documents and pay your very first costs.

Finally, consider scheduling time each year to review your policy. You might intend to upgrade your recipient information if you have actually had any substantial life changes, such as a marital relationship, birth or divorce. Life insurance coverage can in some cases feel difficult. Yet you do not have to go it alone. As you discover your options, take into consideration discussing your needs, wants and worries about a financial specialist.

No, degree term life insurance policy does not have cash value. Some life insurance policy plans have a financial investment feature that allows you to develop money value in time. A section of your costs settlements is reserved and can make rate of interest over time, which expands tax-deferred during the life of your protection.

You have some choices if you still want some life insurance protection. You can: If you're 65 and your insurance coverage has run out, for example, you might want to acquire a new 10-year level term life insurance coverage policy.

What Makes Increasing Term Life Insurance Stand Out?

You might be able to transform your term insurance coverage right into a whole life plan that will certainly last for the rest of your life. Several kinds of degree term policies are exchangeable. That indicates, at the end of your protection, you can convert some or every one of your plan to entire life insurance coverage.

A degree costs term life insurance plan lets you stick to your budget plan while you aid secure your family members. ___ Aon Insurance Providers is the brand name for the broker agent and program administration procedures of Affinity Insurance policy Services, Inc. (TX 13695) (AR 100106022); in CA & MN, AIS Affinity Insurance Coverage Firm, Inc. (CA 0795465); in OK, AIS Fondness Insurance Policy Solutions Inc.; in CA, Aon Affinity Insurance Policy Services, Inc .

Latest Posts

Funeral Insurance Definition

Best Funeral Policy

Best Life Insurance For Funeral Expenses