All Categories

Featured

Table of Contents

- – What Are the Benefits of Term Life Insurance W...

- – What Is Level Term Life Insurance Meaning? The...

- – What is the Meaning of Level Term Life Insura...

- – What Makes Term Life Insurance With Level Pre...

- – What is the Purpose of 10-year Level Term Li...

- – What You Should Know About 20-year Level Ter...

If George is detected with a terminal disease throughout the very first policy term, he probably will not be eligible to renew the policy when it ends. Some plans supply assured re-insurability (without evidence of insurability), but such functions come at a higher cost. There are a number of types of term life insurance coverage.

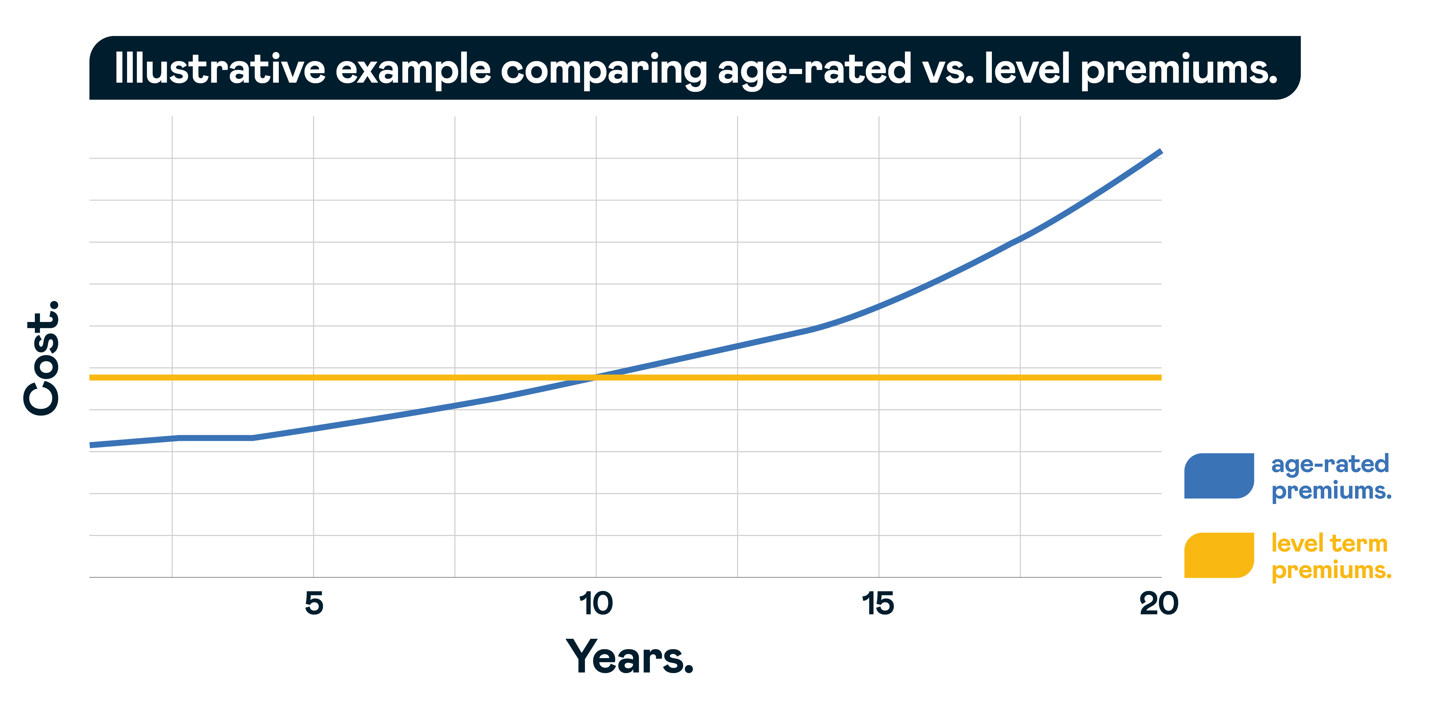

Generally, most firms provide terms varying from 10 to 30 years, although a few deal 35- and 40-year terms. Level-premium insurance coverage has a set month-to-month payment for the life of the plan. Most term life insurance policy has a level premium, and it's the type we have actually been referring to in the majority of this short article.

Term life insurance policy is attractive to youths with youngsters. Moms and dads can acquire considerable coverage for a reduced price, and if the insured dies while the plan is in impact, the family can rely on the fatality advantage to replace lost earnings. These plans are additionally fit for individuals with expanding families.

What Are the Benefits of Term Life Insurance With Accidental Death Benefit?

The right choice for you will depend on your demands. Here are some points to consider. Term life plans are excellent for individuals who desire considerable insurance coverage at a reduced expense. Individuals who possess entire life insurance pay extra in costs for much less protection but have the safety and security of knowing they are shielded permanently.

The conversion rider must enable you to convert to any type of long-term policy the insurer supplies without restrictions. The key attributes of the motorcyclist are keeping the original health and wellness score of the term plan upon conversion (also if you later on have health and wellness problems or come to be uninsurable) and deciding when and just how much of the protection to transform.

Certainly, general premiums will certainly enhance significantly because whole life insurance policy is a lot more expensive than term life insurance policy. The advantage is the assured approval without a clinical exam. Clinical problems that develop throughout the term life period can not trigger costs to be increased. The firm may need limited or full underwriting if you desire to include added riders to the new policy, such as a long-lasting treatment cyclist.

nfinite banking is a financial strategy that empowers you to take control of your finances using the cash value of a whole life insurance policy. By becoming your own banker, you can leverage the cash value to fund large expenses, invest in business opportunities, or handle emergencies—all while your money continues to grow tax-free. For business owners, infinite banking is an invaluable tool for maintaining financial independence and flexibility.

Whole life insurance policies designed for infinite banking offer stability and predictability, ensuring steady cash value growth over time. mortgage protection insurance through an agent. Policies with living benefits further enhance their appeal, offering access to funds for critical illnesses or other urgent needs. Whether you’re looking to finance major purchases, grow your business, or achieve financial independence, infinite banking adapts to your goals while providing long-term security

This concept is especially beneficial for individuals and families seeking flexible financial solutions or business owners aiming to optimize their cash flow. Learn more about how infinite banking can transform your financial future. Schedule a free consultation today and take the first step toward achieving complete financial control.

What Is Level Term Life Insurance Meaning? The Complete Overview?

Term life insurance policy is a reasonably inexpensive method to give a round figure to your dependents if something happens to you. It can be an excellent choice if you are young and healthy and sustain a family. Whole life insurance policy comes with significantly higher monthly costs. It is meant to supply insurance coverage for as lengthy as you live.

Insurance coverage companies established an optimum age restriction for term life insurance plans. The premium likewise increases with age, so a person aged 60 or 70 will pay substantially even more than a person years younger.

Term life is rather comparable to cars and truck insurance. It's statistically unlikely that you'll require it, and the premiums are cash down the tubes if you don't. If the worst takes place, your family will get the benefits.

What is the Meaning of Level Term Life Insurance Meaning?

Essentially, there are two types of life insurance policy plans - either term or permanent strategies or some mix of both. Life insurance firms supply various kinds of term strategies and conventional life plans in addition to "interest delicate" products which have actually ended up being more prevalent given that the 1980's.

Term insurance supplies defense for a given time period. This duration might be as short as one year or offer coverage for a specific number of years such as 5, 10, two decades or to a defined age such as 80 or in many cases as much as the earliest age in the life insurance mortality.

What Makes Term Life Insurance With Level Premiums Different?

Presently term insurance policy rates are extremely affordable and among the most affordable traditionally experienced. It needs to be noted that it is an extensively held belief that term insurance coverage is the least costly pure life insurance policy coverage offered. One requires to review the policy terms thoroughly to determine which term life options are suitable to fulfill your specific scenarios.

With each brand-new term the premium is increased. The right to renew the policy without evidence of insurability is an essential benefit to you. Otherwise, the danger you take is that your health and wellness may wear away and you may be incapable to obtain a plan at the exact same rates and even in all, leaving you and your recipients without insurance coverage.

You have to exercise this alternative during the conversion period. The length of the conversion duration will differ relying on the kind of term plan bought. If you convert within the proposed duration, you are not required to offer any kind of info about your health and wellness. The premium rate you pay on conversion is usually based upon your "present attained age", which is your age on the conversion date.

Under a degree term plan the face quantity of the plan remains the exact same for the entire period. Often such plans are marketed as home mortgage protection with the quantity of insurance policy lowering as the equilibrium of the mortgage decreases.

Commonly, insurance firms have not can change costs after the policy is marketed. Because such policies may continue for several years, insurance firms should use conventional mortality, interest and expense rate estimates in the costs computation. Flexible costs insurance coverage, nevertheless, enables insurance companies to offer insurance coverage at lower "existing" costs based upon much less conservative assumptions with the right to alter these costs in the future.

What is the Purpose of 10-year Level Term Life Insurance?

While term insurance is created to supply defense for a defined time duration, irreversible insurance policy is made to provide insurance coverage for your whole life time. To maintain the costs price degree, the premium at the younger ages exceeds the actual cost of security. This extra premium develops a book (money value) which helps pay for the policy in later years as the price of defense rises above the premium.

Under some policies, costs are required to be spent for an established number of years (Voluntary term life insurance). Under various other plans, costs are paid throughout the insurance holder's lifetime. The insurance coverage company invests the excess costs bucks This kind of plan, which is often called cash value life insurance coverage, produces a financial savings aspect. Cash worths are crucial to a permanent life insurance policy policy.

Often, there is no correlation between the size of the money worth and the costs paid. It is the money value of the policy that can be accessed while the policyholder is active. The Commissioners 1980 Criterion Ordinary Mortality Table (CSO) is the present table made use of in determining minimum nonforfeiture worths and plan gets for common life insurance coverage policies.

What You Should Know About 20-year Level Term Life Insurance

Many permanent plans will certainly include arrangements, which specify these tax obligation demands. Standard whole life policies are based upon long-lasting estimates of expense, rate of interest and mortality.

Table of Contents

- – What Are the Benefits of Term Life Insurance W...

- – What Is Level Term Life Insurance Meaning? The...

- – What is the Meaning of Level Term Life Insura...

- – What Makes Term Life Insurance With Level Pre...

- – What is the Purpose of 10-year Level Term Li...

- – What You Should Know About 20-year Level Ter...

Latest Posts

Funeral Insurance Definition

Best Funeral Policy

Best Life Insurance For Funeral Expenses

More

Latest Posts

Funeral Insurance Definition

Best Funeral Policy

Best Life Insurance For Funeral Expenses