All Categories

Featured

Table of Contents

Life insurance is more than just a policy; it’s a vital tool for protecting your loved ones and securing their financial future. Whether you’re looking for term life insurance to cover immediate needs or whole life insurance for lifelong security, the right policy offers peace of mind during life’s uncertainties. key person insurance for businesses from agents. Affordable options include universal life insurance, which combines flexibility with investment opportunities, or final expense insurance, designed to cover funeral costs and related expenses

For homeowners, mortgage protection life insurance provides added security, ensuring your family can keep their home in case of unexpected events. Accidental death insurance is another valuable option, offering coverage tailored to specific circumstances. Many policies now come with living benefits, allowing policyholders to access funds in cases of critical illness or other emergencies, adding another layer of financial support.

Life insurance adapts to your goals, whether you’re planning for retirement, saving for college, or ensuring your business is protected with key person insurance. Speak with a licensed insurance agent today to discover flexible options that align with your family or business needs. Request a free quote now and take the first step toward a secure tomorrow.

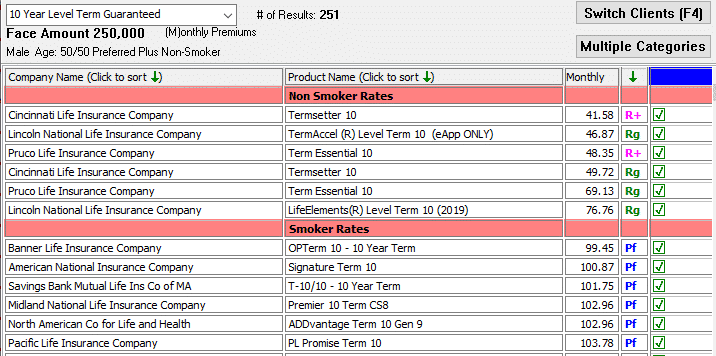

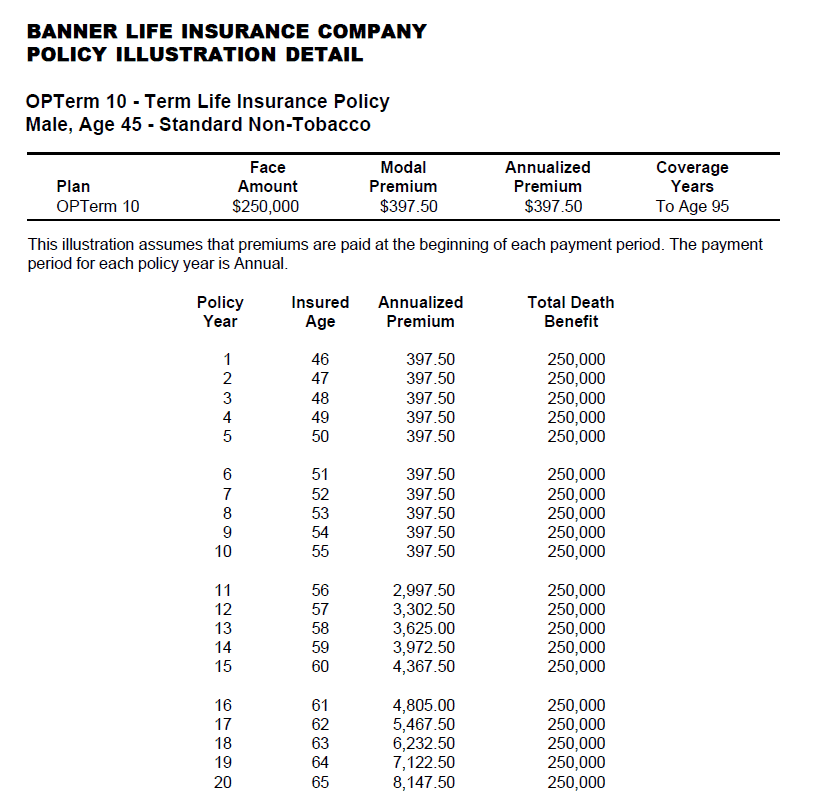

That normally makes them an extra inexpensive alternative forever insurance protection. Some term policies might not keep the premium and fatality profit the very same in time. You do not desire to mistakenly think you're buying degree term coverage and after that have your death advantage modification later on. Many people obtain life insurance policy protection to help financially protect their loved ones in situation of their unforeseen fatality.

Or you may have the alternative to transform your existing term insurance coverage into a permanent plan that lasts the remainder of your life. Different life insurance coverage policies have possible benefits and drawbacks, so it's crucial to recognize each before you decide to purchase a plan.

As long as you pay the costs, your recipients will certainly obtain the death advantage if you pass away while covered. That said, it is necessary to note that many plans are contestable for 2 years which suggests insurance coverage might be retracted on fatality, must a misrepresentation be discovered in the app. Policies that are not contestable commonly have a rated death benefit.

Costs are typically reduced than whole life plans. You're not locked right into a contract for the remainder of your life.

And you can't pay out your policy during its term, so you won't get any economic take advantage of your previous insurance coverage. As with various other types of life insurance, the cost of a level term plan depends on your age, coverage needs, work, lifestyle and wellness. Normally, you'll discover more budget-friendly protection if you're younger, healthier and less dangerous to insure.

Affordable Decreasing Term Life Insurance

Considering that level term premiums stay the exact same throughout of insurance coverage, you'll understand precisely just how much you'll pay each time. That can be a big help when budgeting your expenditures. Degree term coverage additionally has some flexibility, permitting you to personalize your policy with extra functions. These commonly can be found in the type of motorcyclists.

You might need to fulfill certain problems and credentials for your insurance company to pass this cyclist. Additionally, there may be a waiting duration of as much as 6 months before working. There additionally can be an age or time limitation on the coverage. You can include a youngster cyclist to your life insurance policy policy so it additionally covers your kids.

The survivor benefit is commonly smaller sized, and insurance coverage generally lasts up until your youngster transforms 18 or 25. This cyclist may be a more economical method to help ensure your children are covered as cyclists can commonly cover numerous dependents at the same time. When your kid ages out of this insurance coverage, it may be possible to convert the biker into a new plan.

The most common type of irreversible life insurance policy is whole life insurance, however it has some key differences compared to degree term protection. Here's a basic review of what to take into consideration when comparing term vs.

Proven Voluntary Term Life Insurance

Whole life insurance lasts for life, while term coverage lasts for a specific period. The costs for term life insurance coverage are usually lower than whole life coverage.

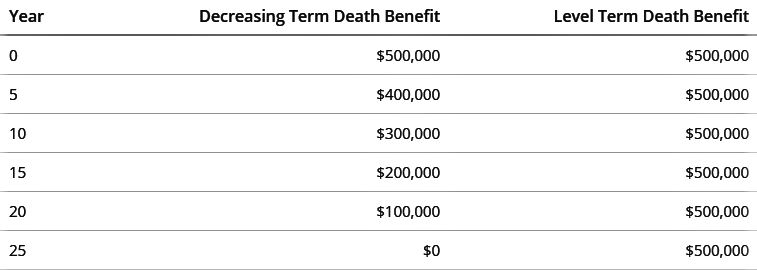

One of the major attributes of level term coverage is that your costs and your death benefit don't alter. You may have insurance coverage that starts with a death advantage of $10,000, which can cover a mortgage, and after that each year, the death advantage will certainly lower by a collection amount or percentage.

Because of this, it's usually an extra economical type of degree term insurance coverage. You may have life insurance policy with your employer, but it might not be adequate life insurance policy for your needs. The primary step when acquiring a plan is identifying just how much life insurance policy you require. Consider elements such as: Age Household dimension and ages Work condition Income Financial obligation Way of life Expected final expenditures A life insurance coverage calculator can aid identify just how much you need to begin.

After picking a policy, finish the application. For the underwriting process, you may have to provide general personal, health, lifestyle and employment information. Your insurer will establish if you are insurable and the danger you might present to them, which is shown in your premium costs. If you're approved, sign the documents and pay your very first costs.

Budget-Friendly Level Term Life Insurance Definition

Take into consideration organizing time each year to review your policy. You may wish to update your beneficiary info if you've had any type of significant life changes, such as a marital relationship, birth or separation. Life insurance coverage can sometimes feel difficult. You do not have to go it alone. As you discover your choices, take into consideration reviewing your needs, wants and interests in a financial expert.

No, level term life insurance policy does not have cash value. Some life insurance policy plans have a financial investment function that enables you to construct cash money worth in time. A portion of your costs payments is reserved and can gain interest gradually, which expands tax-deferred during the life of your coverage.

Nevertheless, these policies are frequently considerably a lot more costly than term coverage. If you get to completion of your policy and are still active, the coverage finishes. You have some choices if you still want some life insurance coverage. You can: If you're 65 and your insurance coverage has actually run out, as an example, you might desire to buy a brand-new 10-year degree term life insurance policy policy.

High-Quality What Is Direct Term Life Insurance

You may be able to convert your term protection right into a whole life policy that will last for the rest of your life. Numerous sorts of degree term policies are exchangeable. That suggests, at the end of your insurance coverage, you can transform some or all of your plan to entire life protection.

Level term life insurance is a plan that lasts a set term generally in between 10 and 30 years and includes a degree fatality benefit and degree premiums that stay the exact same for the entire time the policy holds. This implies you'll understand exactly just how much your settlements are and when you'll need to make them, allowing you to spending plan as necessary.

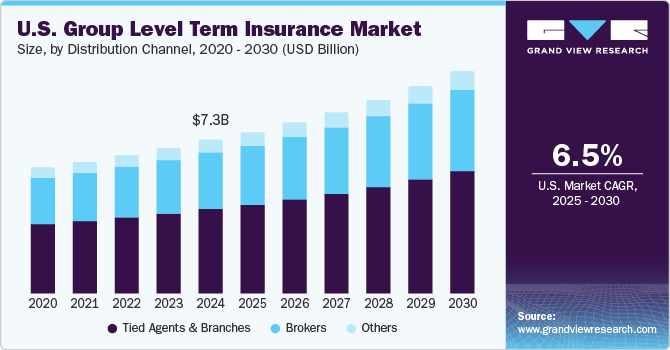

Level term can be an excellent choice if you're wanting to purchase life insurance coverage for the very first time. According to LIMRA's 2023 Insurance coverage Barometer Research, 30% of all adults in the united state demand life insurance policy and do not have any kind of kind of plan yet. Degree term life is foreseeable and budget friendly, that makes it among the most popular types of life insurance coverage.

Latest Posts

Funeral Insurance Definition

Best Funeral Policy

Best Life Insurance For Funeral Expenses