All Categories

Featured

Table of Contents

Which one you choose depends upon your demands and whether the insurance company will authorize it. Plans can additionally last until specified ages, which in many cases are 65. As a result of the many terms it supplies, level life insurance policy gives potential policyholders with versatile choices. Beyond this surface-level details, having a better understanding of what these plans involve will certainly aid guarantee you acquire a plan that fulfills your demands.

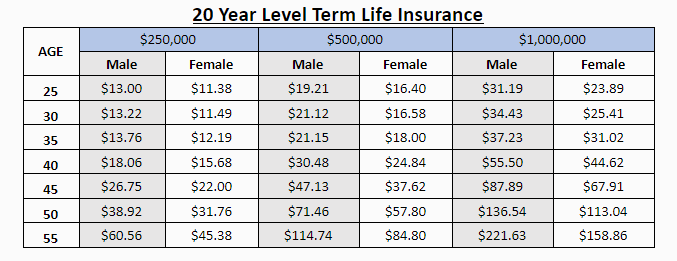

Be conscious that the term you pick will affect the premiums you spend for the plan. A 10-year degree term life insurance policy policy will certainly cost much less than a 30-year plan because there's much less chance of an incident while the plan is active. Lower danger for the insurance company equates to reduce premiums for the insurance policy holder.

Your family's age need to additionally influence your plan term option. If you have young kids, a longer term makes good sense because it shields them for a longer time. Nevertheless, if your kids are near adulthood and will certainly be monetarily independent in the future, a much shorter term might be a much better fit for you than a lengthy one.

When contrasting whole life insurance vs. term life insurance policy, it's worth keeping in mind that the last normally costs less than the previous. The result is more protection with reduced costs, giving the very best of both globes if you need a considerable amount of insurance coverage yet can not pay for an extra pricey policy.

What is Increasing Term Life Insurance? Pros and Cons

A level fatality advantage for a term policy typically pays out as a swelling sum. Some degree term life insurance coverage companies allow fixed-period repayments.

Rate of interest repayments got from life insurance policy plans are thought about revenue and are subject to tax. When your level term life plan expires, a few various points can happen.

The disadvantage is that your eco-friendly degree term life insurance will come with greater premiums after its preliminary expiry. Advertisements by Cash.

Life insurance coverage firms have a formula for calculating risk using death and interest (Short Term Life Insurance). Insurance firms have thousands of clients obtaining term life policies at as soon as and use the premiums from its active plans to pay surviving recipients of other policies. These business utilize mortality to approximate exactly how several people within a certain group will file fatality cases per year, and that info is made use of to determine average life span for prospective insurance policy holders

In addition, insurance companies can spend the money they obtain from premiums and boost their earnings. The insurance firm can invest the cash and earn returns.

The list below area information the pros and cons of degree term life insurance policy. Foreseeable costs and life insurance policy protection Streamlined plan structure Potential for conversion to permanent life insurance policy Minimal protection duration No money worth build-up Life insurance policy premiums can enhance after the term You'll discover clear benefits when comparing degree term life insurance policy to other insurance kinds.

What Does Level Term Life Insurance Policy Provide?

From the moment you take out a policy, your costs will never transform, helping you intend economically. Your coverage will not differ either, making these plans efficient for estate preparation.

If you go this route, your premiums will certainly enhance however it's constantly great to have some adaptability if you wish to maintain an active life insurance policy policy. Eco-friendly level term life insurance policy is an additional option worth thinking about. These plans allow you to keep your present strategy after expiry, giving versatility in the future.

Is Annual Renewable Term Life Insurance the Right Fit for You?

You'll choose a protection term with the finest level term life insurance policy prices, but you'll no longer have protection once the strategy expires. This disadvantage can leave you scrambling to locate a brand-new life insurance policy in your later years, or paying a premium to extend your current one.

Several whole, global and variable life insurance policy policies have a money worth part. With among those plans, the insurance firm transfers a part of your month-to-month premium payments into a cash value account. This account gains passion or is invested, assisting it expand and supply an extra significant payment for your recipients.

With a level term life insurance plan, this is not the situation as there is no money worth component. Because of this, your plan won't expand, and your survivor benefit will never ever enhance, thereby limiting the payment your beneficiaries will receive. If you want a policy that provides a death benefit and constructs cash money worth, consider whole, universal or variable plans.

The 2nd your plan ends, you'll no longer have life insurance protection. It's often possible to restore your plan, but you'll likely see your premiums increase considerably. This might provide concerns for retirees on a set earnings because it's an extra cost they could not be able to manage. Level term and decreasing life insurance policy deal similar policies, with the major difference being the death advantage.

Navigating life insurance options can be overwhelming, especially with so many policies available. This is where working with an experienced insurance broker or agent makes all the difference. Unlike insurance agents tied to a single provider, brokers offer access to multiple life insurance options, helping you find the most suitable policy for your needs - final expense life insurance brokers. Whether it’s term life insurance for temporary coverage, whole life insurance for lifelong protection, or universal life for long-term growth, an insurance broker evaluates your unique goals and compares providers to secure the best coverage at competitive rates

For families, policies like final expense insurance, mortgage protection, and accidental death coverage offer tailored solutions to protect loved ones. Business owners can also benefit from key person insurance, ensuring continuity in the event of an unforeseen loss. With life insurance policies offering living benefits or instant coverage, brokers simplify the decision-making process and ensure your financial priorities are met.

By choosing the right insurance broker, you gain expert guidance, access to personalized recommendations, and the confidence of knowing your family or business is secure. Contact an insurance broker today to explore tailored life insurance options and secure peace of mind for the future.

It's a type of cover you have for a particular quantity of time, called term life insurance policy. If you were to die throughout the time you're covered for (the term), your enjoyed ones obtain a set payout concurred when you obtain the plan. You just choose the term and the cover quantity which you could base, for instance, on the price of raising children up until they leave home and you can make use of the settlement in the direction of: Assisting to settle your mortgage, financial obligations, credit cards or car loans Assisting to spend for your funeral costs Aiding to pay college charges or wedding expenses for your kids Helping to pay living costs, changing your revenue.

What is Simplified Term Life Insurance? A Simple Explanation?

The policy has no cash value so if your settlements quit, so does your cover. If you take out a degree term life insurance policy you can: Choose a fixed quantity of 250,000 over a 25-year term.

Latest Posts

Funeral Insurance Definition

Best Funeral Policy

Best Life Insurance For Funeral Expenses